Join the movement

Join us in our mission to take ambitious action on biodiversity!

Financial institutions worldwide, your participation is vital in our collective effort to protect biodiversity.

We invite you to be part of our community by:

- Signing the Finance for Biodiversity Pledge and

- Becoming a member of the Finance for Biodiversity Foundation and actively participating in our working groups and subgroups

What is the difference between a signatory and a member?

Signatories

As an FfB Pledge Signatory, you commit to act on the five Pledge commitments.

Members

An FfB Pledge signatory can choose to become an FfB Foundation member. As a member you will benefit from the following:

- Participate in our working groups

- Best practice examples from peers

- Webinars from experts

- Free biodiversity company and sector data

- Yearly advice and progress benchmark via an individual report

- Yearly in-person networking events

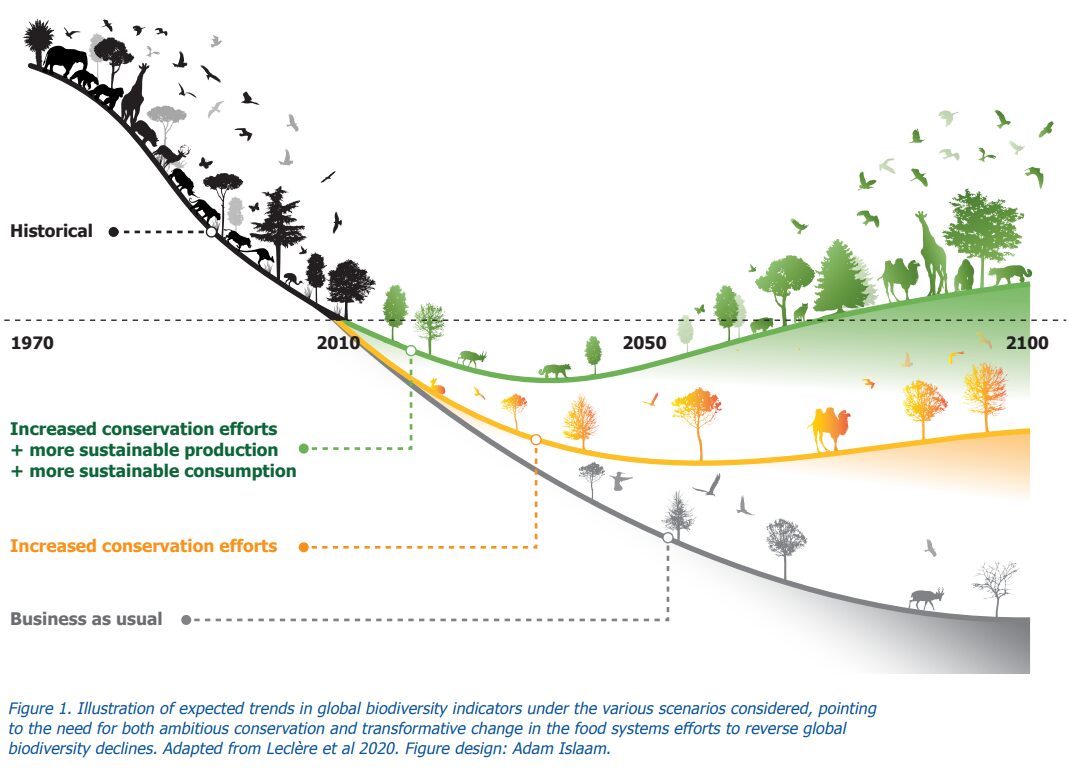

Our mission

Supporting a call to action and collaboration among financial institutions to reverse nature loss this decade.

Image source: IIASA

A growing movement

…supported by CEOs of 200 financial institutions.

Amanda Blanc

CEO Aviva Plc

“The world urgently needs to protect its precious and increasingly threatened biodiversity and, as the U.K.’s leading insurer, Aviva has a responsibility to use our influence to help do just that. We are proud to sign up to the Finance for Biodiversity Pledge, joining with others to act together for a better tomorrow.”

Christos Megalou

CEO Piraeus Financial Holdings

“Having the largest market share in the agrifood business in Greece, we realize the responsibility we have to set targets to protect natural resources and to ensure a healthy and environmentallyfriendly food system.”

Liza Jonson

CEO Swedbank Robur

“We are a proud signatory of this Pledge. The focus on biodiversity goes well with Swedbank Robur’s Climate Strategy – to align our managed fund capital with the Paris Agreement by 2025 and carbon neutral 2040.”

The Pledge Commitments

We, 200 financial institutions, representing EURO 23 trillion in assets, call on global leaders to take effective measures to reverse nature loss this decade and to ensure ecosystem resilience.

As financial institutions, we know that healthy societies, resilient economies and thriving businesses rely on nature. Together let’s protect, restore and sustainably manage our natural resources. We make every effort to take our share of responsibility and contribute to the protection and restoration of biodiversity and ecosystems through our financing activities and investments.

We, therefore, commit to do the following by 2024 at the latest, or within two years after signing the Pledge:

Collaboration and knowledge sharing

We will collaborate and share knowledge on assessment methodologies, biodiversity-related metrics, targets and financing approaches for positive impact.

Engaging with companies

We will incorporate criteria for biodiversity in our ESG policies, while engaging with companies to reduce their negative and increase their positive impacts on biodiversity.

Assessing impact

We will assess our financing activities and investments for significant positive and negative impacts on biodiversity and indentify drivers of its loss.

Setting targets

We will set and disclose targets based on the best available science to increase significant positive and reduce significant negative impacts on biodiversity.

Reporting publicly

We will report annually and be transparent about the significant positive and negative contribution to global biodiversity goals linked to our financing activities and investments in our portfolios.